Tokenization & Registration

Tokenization allows you to store the payment data for later use. This can be useful for recurring and/or one-click payment scenarios.

This guide describes how you can store the data using our Server-to-Server API, how you can subsequently use the stored card details for a one-click payment and how to delete stored data.

Storing the payment data

There are two methods for creating a token

- Store the data during a payment

- Store the data as stand-alone

Store the data during a payment

A payment's data can be stored at the same time as the payment by sending the createRegistration parameter with a value of true. This is done by sending a POST request to the /payments endpoint.

Try it out in the interactive editor below and you will find that you get the additional response parameter registrationId. This parameter allows you to access the stored payment data during subsequent operations (see use cases below).

Store the data as stand-alone

A registration can also be made by calling the /registrations endpoint as a stand-alone request (i.e. without requesting a payment).

Contrary to the registration as part of a payment, you directly receive a registration object in your response. Therefore the ID to reference this data during later payments is the value of field id

-

Using the stored payment data

Use Case 1: Recurring Payments

Based on the stored account details recurring payments become very simple to achieve.

All you need to do is to add the parameter

standingInstructionto your requests:- For the initial payment request you should send the

standingInstruction.modewith valueINITIALandstandingInstruction.typewith valueUNSCHEDULEDandstandingInstruction.sourcewith valueCIT. - For any subsequent payment you should send the

standingInstruction.modewith valueREPEATED.andstandingInstruction.typewith valueUNSCHEDULED,standingInstruction.sourcewith valueMITandstandingInstruction.initialTransactionIdwith a value as ID received in the response of the initial CIT transaction.

The Recurring Payment tutorial explains this scenario in more detail. Follow the section Card On File for possible

standingInstructionparameters. - For the initial payment request you should send the

-

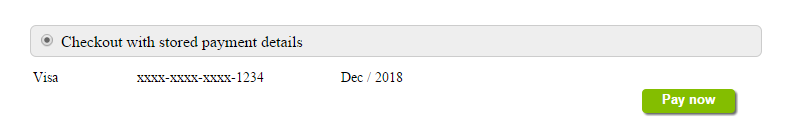

Use Case 2: One-Click Payments

After storing a customer's account details, it is possible to offer a 'one-click payment' checkout, to simplify subsequent purchases.

Basically you're using the token you've received in the original payment's response in the field

registrationId/idto reference and even prefill a customer's payment form.

The One-click Payment tutorial explains this scenario in more detail.

Deleting the stored payment data

Once stored, a token can be deleted using the HTTP DELETE method against the registration.id: